I have RSUs, but didn’t sell any. Why is my tax bill so crazy?

If you work for a public tech company, or a private company that’s about to go public (hello - Coinbase, Oscar Health, Instacart and Rivian!), it’s highly likely that restricted stock units, or RSUs, are part of your compensation structure. Restricted stock units are a form of equity compensation that give you ownership in the company. It’s not uncommon for a large portion of your compensation to be granted in the form of RSUs. This can be advantageous if you’re part of a growing company, and particularly if you were an early employee in a growing company. However, while RSUs aren’t terribly complicated from a tax perspective, they can cause tax confusion, because the IRS withholding rules are different from how they are actually taxed. In today’s blog, we want to break down the options you have in dealing with these tax issues, and shed some light on why they happen.

Restricted stock units are equivalent to owning a share in your company’s stock. When you receive RSUs as part of your compensation, they are taxed as ordinary income. Think of it like a cash bonus that your company immediately invests into company stock and gives you the stock instead. The tricky part isn’t about how the RSUs are taxed, but rather it’s the difference in how the IRS requires companies to withhold that tax versus how they are actually taxed.

How are RSUs taxed?

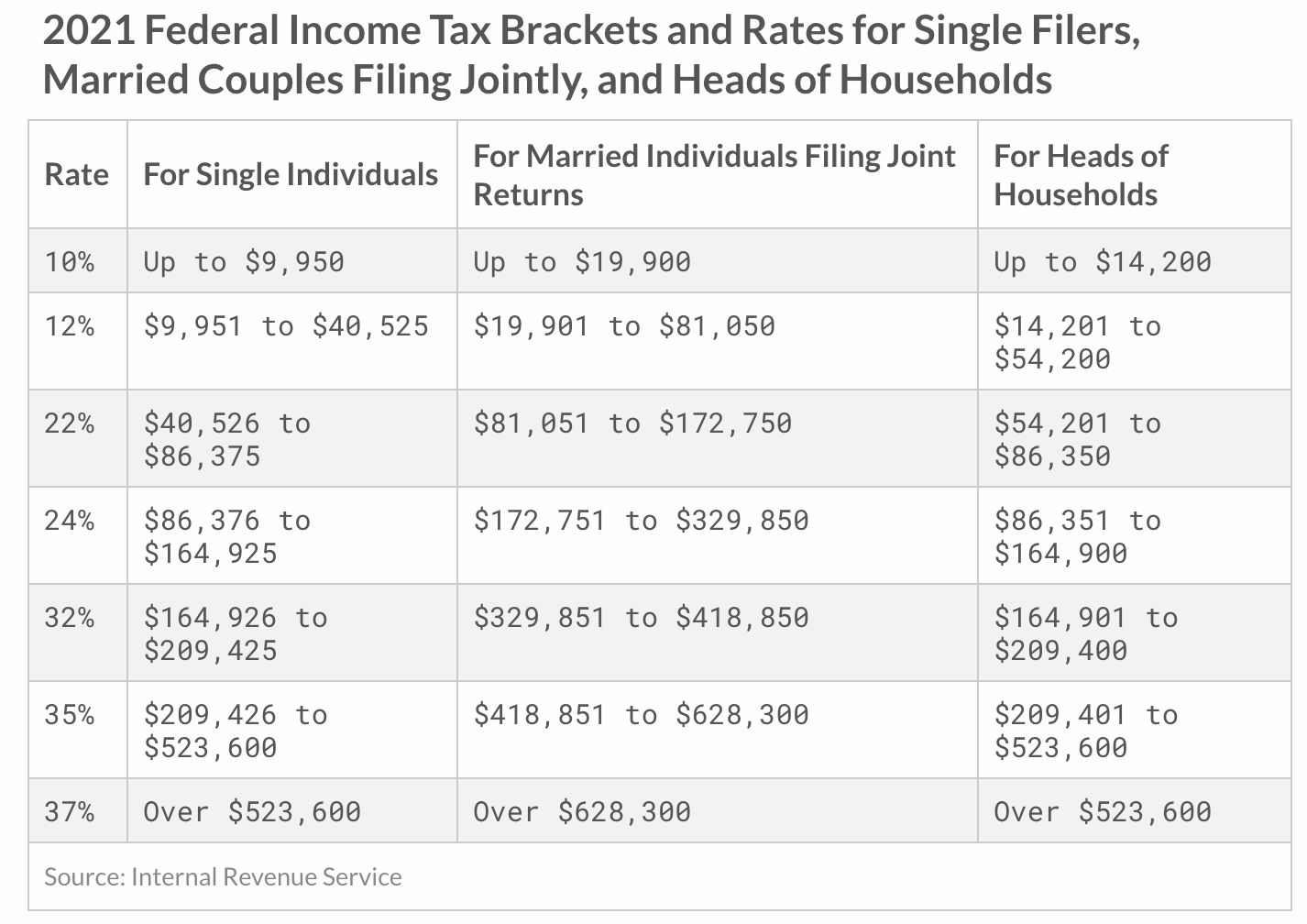

When the Tax Cuts and Jobs Act was passed, the IRS amended their rules to only require supplementary income (like bonuses, commission, or stock compensation) of up to $1 million to be withheld at Federal rates of 22% versus the previous 25%. What this means is that when you are paid in RSUs and you make less than $1 million, your employer will likely only send 22% of the RSU value to the IRS to cover the taxes you owe. The employer usually does this by selling shares of your RSUs on the date they vest. So let’s say that you were meant to earn $100k of RSUs and this consisted of 100 shares of stock, each valued at $1,000/share. On the day of vesting, your employer would sell 22% of these shares in the market and use this cash to cover your tax withholding obligation. Instead of receiving the 100 shares of stock, you would receive 78 shares of stock, because 22 shares were sold by your company to cover taxes. The problem is that although the withholding requirement is only 22%, the amount of tax you owe is actually based on your tax rates. We’ve included the schedule from 2021 below to further illustrate this point.

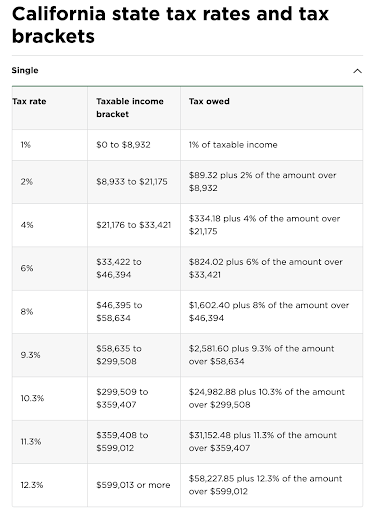

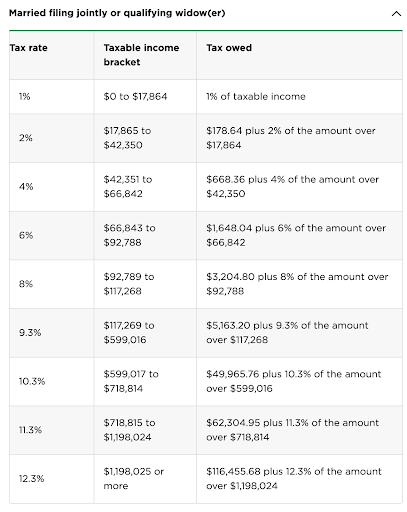

If you’re a single person and your total income, including your salary, bonus and your stock compensation is under $86,375, then this 22% withholding on your RSUs is sufficient. But in most cases we’ve seen, people are earning more than the 22% bracket, which ends up causing the issue. Let’s use a single person earning $250k/year as the example, and this person earns $200k in RSUs this year. Without making any adjustments, and assuming the company correctly withholds for taxes on the salary portion of the compensation, the company will withhold 22% of the $200k RSU income for taxes - or $44k. However, because this person earns $250k as a salary, any income above $250k and below $523,600, would result in taxes owed of 35%. This means that instead of owing $44k on the $200k of RSU income, this person would actually owe 35% of the $200k, or $70k. When tax time comes around, this is why there can be such a big tax bill. The disparity of what you owe versus what you withheld is the result of this supplementary withholding rule. For high income earners, this can also impact you at the State level. In California, we see most companies withholding at 10.23%, but as you can see below (source: NerdWallet), if your overall earnings exceed $299,509, then 10.23% won’t be enough.

The more money you make, the higher of an impact this can create. For individuals in the highest tax brackets, this can result in an underpayment of 15% of the value you earn in RSUs in federal taxes in addition to state taxes. For those with a large portion of your compensation is in RSUs, this can really add up! Plus, if the IRS or state deems that you have not paid enough into taxes throughout the year, you could be charged penalties for underwithholding. Furthermore, if your stock has already gone public and is quickly increasing in price, any of your newly vested shares will be taxed based on the price at which they vest.

Altogether, these aren’t bad problems to have. Ultimately if your stock price continues to rise, you’ll be in a better position to sell shares to meet the tax obligations. However, if your stock price goes down, you may find yourself in a scenario where you owe taxes on stock that you now have to sell at a loss to meet the obligations.

You have three options for managing your RSU taxes.

Option 1: Contact HR to adjust your withholdings.

This isn’t always a possibility, but the easiest way to be sure you’re paying enough in tax is to adjust your withholdings. Contact your HR representative or whoever at your firm manages the stock compensation. You’ll want to adjust your withholdings to your marginal tax bracket, or, the highest tax bracket that your pre-RSU compensation will reach. For example, if you earn $250k in salary and your RSU income is on top of that, you will want to adjust your Federal withholding to 35% and your California state withholding should be fine for the next $50k of income (or more, including pre-tax deductions). If you’re in between tax brackets, you may opt for the higher withholding if you prefer to receive a tax refund, or the lower withholding if you would prefer to save a bit extra in a savings account to account for your tax bill.

Option 2: Sell RSUs upon vesting.

This is ultimately the same strategy as Option 1, but you are executing the trades versus it happening automatically. This is a great option to be sure that you cover your taxes without large fluctuations in the stock price impacting your ability to do so. Depending on how often your stock vests, you may run into issues around trading windows, where you are unable to trade shares on certain days. We recommend reviewing the open trading windows early in the year and creating a schedule you can stick to.

If your RSU prices changed from when they first vested, you may owe additional taxes. We recommend a combination of two strategies in selling positions:

Sell RSUs that recently vested that have not moved much in price, or are potentially held at a loss. Each year, you are able to deduct up to $3,000 of short term capital losses on your tax return, to offset ordinary income. If you are holding any shares that are at a loss, these are a good option! Alternatively, if the shares haven’t moved much in value, the tax implications will be small and easy to manage.

Sell RSUs that you have held for over one year. Long term capital gains rates are preferential to short term capital gains rates for federal tax purposes. If you’re curious on how much you will trigger in capital gains taxes, we recommend consulting with a CPA or using SmartAsset’s capital gains tax calculator.

To be clear, selling RSUs does not create the tax burden unless the price of the stock has changed since the share first vested. Regardless if you sell or hold the RSU, you will be taxed on the full value of the shares held. It is the difference between the price you purchased the RSU (the vesting price) and the price you sell the RSU that triggers capital gains taxes.

If your tax obligations are significant enough - we recommend consulting a CPA to determine your safe harbour obligations to avoid any tax penalties - you should pay quarterly estimates to the IRS and your state using the proceeds from your stock sales.

Option 3: Wait until tax time to sell RSUs to meet tax obligations.

If you’re confident in your company and believe the stock price will continue to rise, you may consider waiting until tax time to sell your shares. This can work out in your favor if your stock price does continue to go up, but we have seen this strategy backfire, because you are taking a risk of having to sell during a very specific time period. For example, had you tried to use this strategy and sold in March 2020, your stock might have been down 30-50% from its highs in February.

You should continue to be aware of any closed trading windows that would preclude you from trading, as well as confer with a CPA to ensure that you won’t be charged tax penalties for underpaying throughout the year.

If you do decide to wait until tax time to liquidate your RSUs, we recommend that you use the same strategies we detailed under Option 2.

Creating a strategy that’s right for you

Remember that every option has its pros and cons. Option 1 is easy and ensures you’re paying enough tax on time, but sacrifices potential investment returns if your company continues to thrive. Option 3 gives you the greatest chance of increasing your wealth if your company grows faster than your other investments, but can penalize you if you haven’t enough liquidity in your net worth to cover taxes, in the case that the stock price drops. What’s important is that your stock compensation strategy is part of your greater financial strategy. It should take into consideration the risks that are known, as well as the risks that are unknown. While we may think we know the trajectory of a specific company or stock, ultimately anything can happen. If your strategy is prepared for that, then you’ll do just fine.

If you’re interested in learning more about how we think about stock compensation, below are a few other blog posts we’ve written over the years:

Stephanie Bucko and Cristina Livadary are fee-only financial planners based in Los Angeles, California. Stephanie is the Chief Investment Officer and Cristina is the Chief Executive Officer at Mana Financial Life Design (FLD). Mana FLD provides comprehensive financial planning and investment management services to help clients grow and protect their wealth throughout life’s journey. Mana FLD specializes in advising ambitious professionals who seek financial knowledge and want to implement creative budgeting, savings, proactive planning and powerful investment strategies. As fee-only fiduciaries and independent financial advisors, Stephanie and Cristina never receive commission of any kind. Stephanie and Cristina are legally bound by their certifications to provide unbiased and trustworthy financial advice.